Analysis. The coronavirus crisis was to herald a demondialization, a return to short circuits and to economies on a human scale. Wall Street makes a radically opposite prediction. The world of tomorrow will be that of yesterday, more cartellated, more globalized, more technological and more virtual. With the victory of the most powerful, starting with the Internet giants, despite the correction on Friday 1er may. This is what suggests the American Stock Exchange, whose main index, the S&P 500, has declined only 12% since the beginning of the year, when the CAC 40, it lost 25%. The disaster is appalling, with 65,000 dead, 30 million unemployed and a 5.7% recession in 2020, according to the International Monetary Fund (IMF). But Wall Street dreams of stepping over the crisis, boosted by the "visible hand of the market," namely the Federal Reserve (Fed) and Congress, which, informed by the 1929 crisis, flooded the market with liquidity and subsidies.

Speculative madness? Blindness of operators, who are deluding themselves about the speed of return to normal? No doubt, or maybe. The interest is elsewhere. As the The Wall Street Journal, "the stock market boom may not be as crazy as it sounds." It made a drastic selection between stocks, while most companies took stock when publishing their quarterly results. The collapse is not general that, already, the winners (Silicon Valley, oligopolies rich in cash flow like big consumption) and the losers (energy, transport, SMEs, farmers) appear. And winners among the losers, such as the majors Exxon or Chevron, who can profit from the bankruptcy of independent oil producers in Texas. Overview.

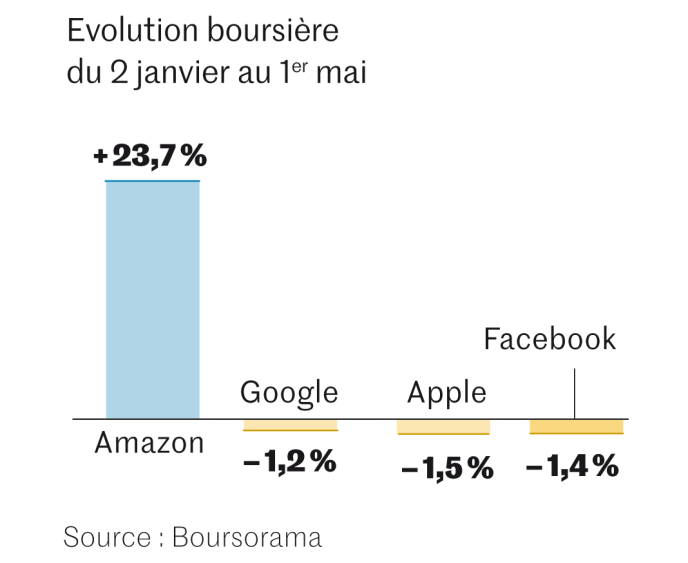

The growing hegemony of the "Gafam"

Thursday April 30, Jeff Bezos took the pen to announce his quarterly results. "If you are an Amazon shareholder, it is better to sit down, because we do not see small", explained the boss and founder of Amazon, announcing that all of the second quarter profits (4 billion dollars, or 3.6 billion euros) would be wiped out by the expenses due to the Covid-19 to protect employees and customers . The stock fell 7.6%, but remains on a gain of 24% since the start of the year. The strategy is in line with that set out by Mr. Bezos in his first letter to shareholders in 1997: the customer, market share and power before profits. His ambition remains intact, namely to be in battle order for a way out of the crisis (facing another giant, Walmart, in top form). With a 26% increase in revenue in the first quarter, Amazon was a victim of its success, struggling to keep up with the demand of confined Americans.

You have 80.09% of this article to read. The suite is reserved for subscribers.